Henry Singleton’s Teledyne Return Metric

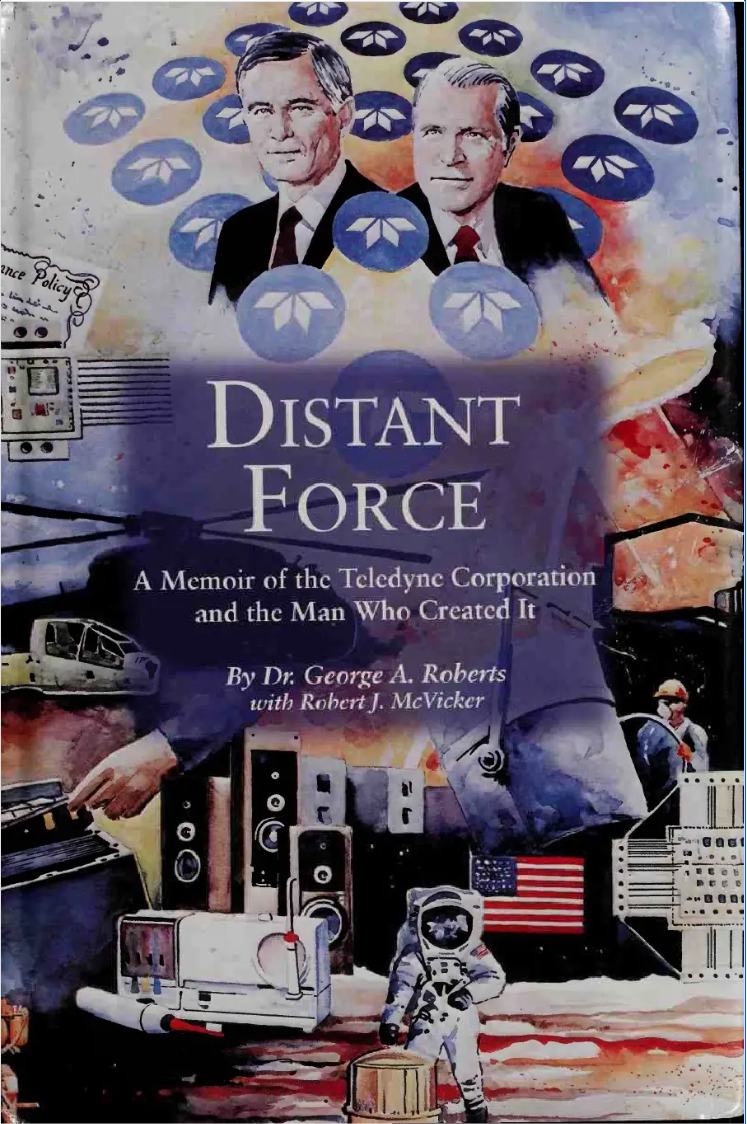

I’m finishing Distant Force: A Memoir of the Teledyne Corporation and the Man Who Created It. The book details Teledyne’s rise from inception to conglomerate with billions in revenue and hundreds of operating companies. This book interested me because I was curious to learn the specifics of how Henry Singleton developed and executed his capital allocation strategy—the same strategy Warren Buffett likely borrowed from to build Berkshire Hathaway.

The book details how Teledyne managed its sprawling operations and evaluated the performance of each operating company. I assumed that Singleton used free cash flow or something similar to measure each operating company’s financial performance. I was wrong. Singleton created his own metric, the Teledyne return, which measured profitability and net cash flow in a single number.

The Teledyne return was an average of net cash flow and profit. The book gives the following example:

- Reported profit: $1,000,000

- Reported cash flow: $500,000

- Teledyne return: $750,000 = ($1,000,000 + $500,000)/2

The company’s thinking was this: Your profit was $1,000,000, but you received only $500,000 in cash. We’ll credit you fully for profits booked and received as cash. We’ll give you credit for some of the profit booked but not yet collected.

This single metric forced company presidents to focus on profit and cash flow simultaneously. It also allowed Teledyne corporate to standardize its comparison of operating company results.

I’ve seen profits or cash flow used to evaluate financial performance, but I never thought a singular focus on either made sense. When I ran my company, I kept a close eye on free cash flow and net income. By looking at both, I was ensuring that we were generating profitable revenue and that we collected revenue faster than we had to pay our expenses.

Singleton’s Teledyne return is a creative way to force managers to focus on what matters most. For entrepreneurs it’s a financial metric worth considering if it makes sense for their specific business.

You can listen to audio versions of my blog posts on Apple here and Spotify here.